Business Outline(Product Lineup)

Upholding our shared corporate principles and policies, Mandom Group is developing business operations by analyzing and understanding the characteristics of each market and adapting to the needs of local communities. Our ultimate goal is to provide Dedication to Service (Oyakudachi) for our customers in every country where we operate. The company is engaged in two major businesses, the men's segment and the women's segment, aspiring to become the company that is wanted and needed by our customers.

Group Operations

Area of Group Business Operations

●Japan

The Japanese cosmetic market, estimated to be worth approximately 1,500 billion yen (Current Survey of

Production by the Ministry of Economy, Trade and Industry), is already mature and we cannot expect further

strong growth, as Japan faces a declining birthrate and an aging population.

As the nation's top

manufacturer of men's cosmetics, Mandom always explores and seizes business opportunities by suggesting new

categories and values.

Mandom's recent effort has been a big input into women's cosmetics. Fully

exploiting the distribution channels the company has developed to date, it is deploying unique strategies,

proposing functional and affordable skincare products to be sold in self-service stores and developing and

selling women's body care products based on know-how gained from producing and marketing men's cosmetics.

●Indonesia

Indonesia is an emerging economy, with an expanding middle-income group, an improved income level and a

rapidly changing living environment, which lead to changes in its consumers' cosmetics purchasing behavior.

Their focus of consumption is shifting from daily essentials to more luxury items and, probably in due

course, to high value-added products. The market will continue to grow.

Mandom is one of the leading

men's cosmetics manufacturers in the country, boasting a hair styling market share of over60%. It is also

increasing steadily its sales of women's cosmetics, mainly makeup and fragrance products.

●Other Countries/Areas

Thanks to economic growth, other markets as a whole seem to be continuing to expand. However, markets of

higher GDP countries such as Singapore, Hong Kong, Taiwan, and South Korea are maturing. Many Japanese and

Western manufacturers have already entered these markets and competition has intensified.

In other

markets such as Indochina, including Thailand, Malaysia, and the Philippines, cosmetics are rapidly

diffusing, particularly in urban areas. Greater demand is expected as consumers become even more interested

in cosmetics and the market spreads wider to rural areas.

Share of net sales by area (FYE March 2025)

Net sales by area (unit: million yen)

Beginning from the fiscal year ending March 31, 2019, some items that had been processed as expenses have been deducted from net sales at overseas consolidated subsidiaries included in financial statements prepared in accordance with IFRS.

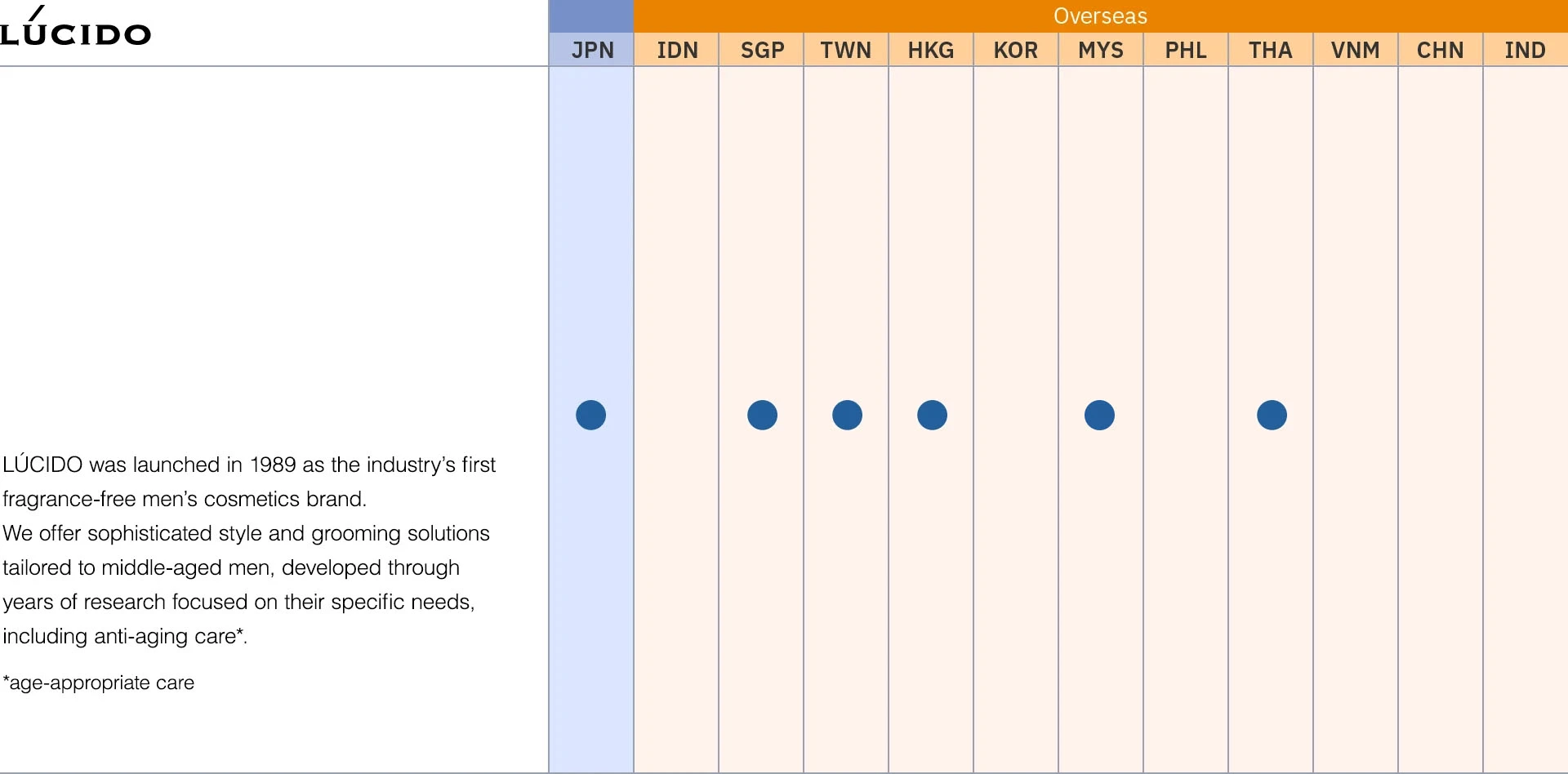

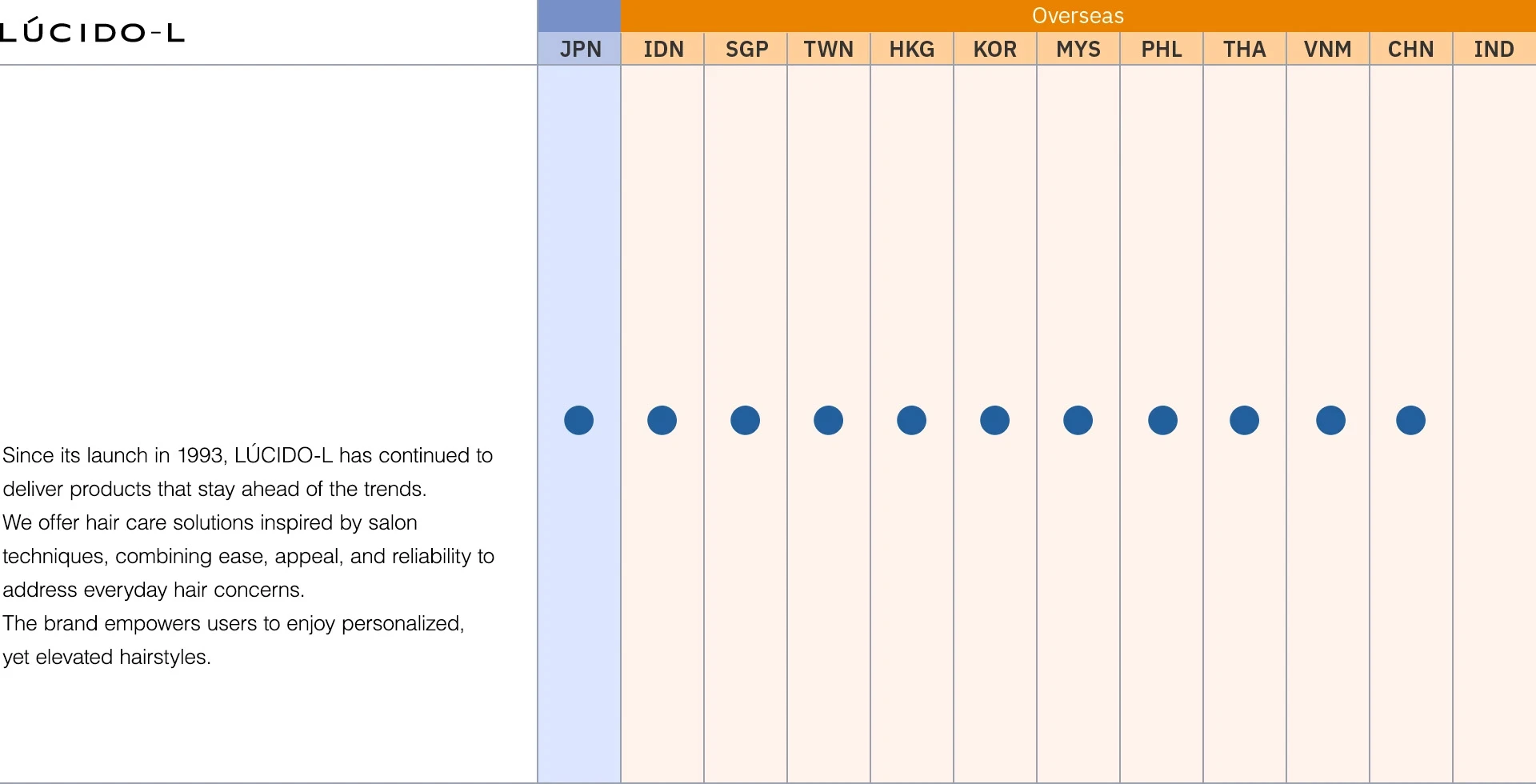

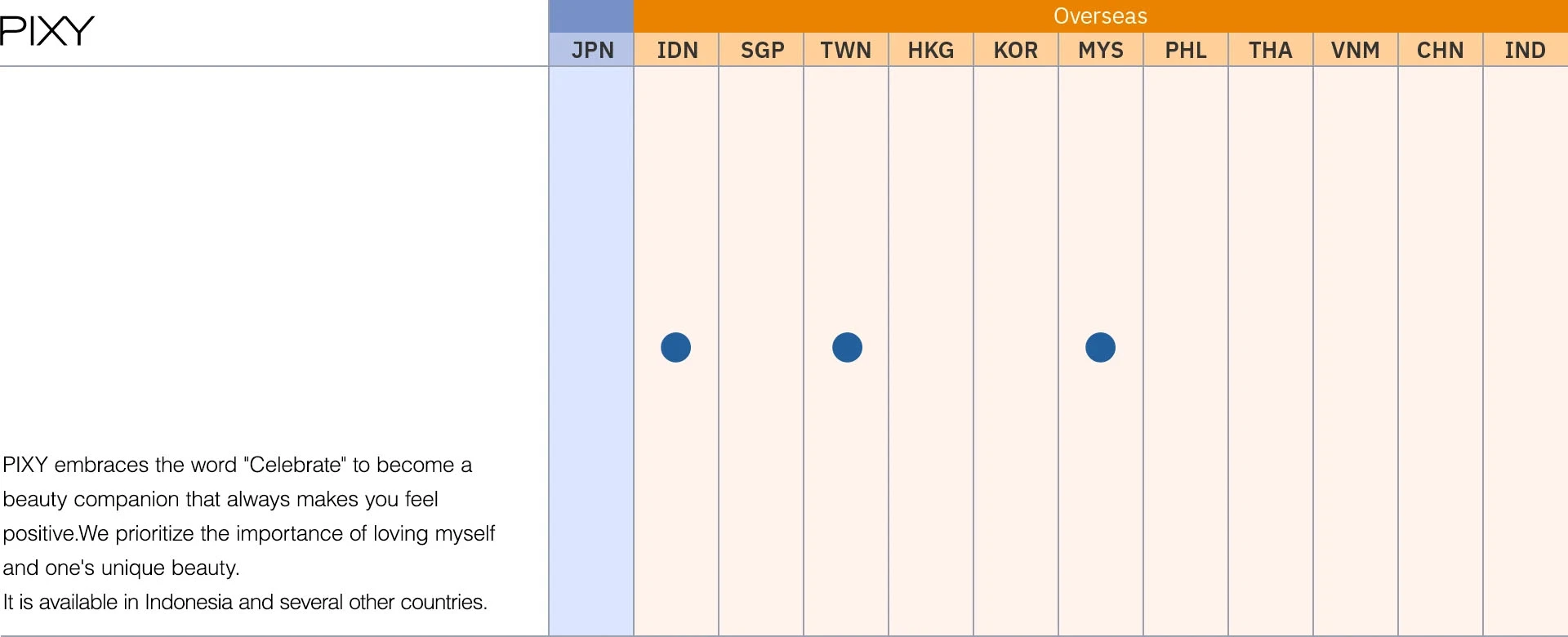

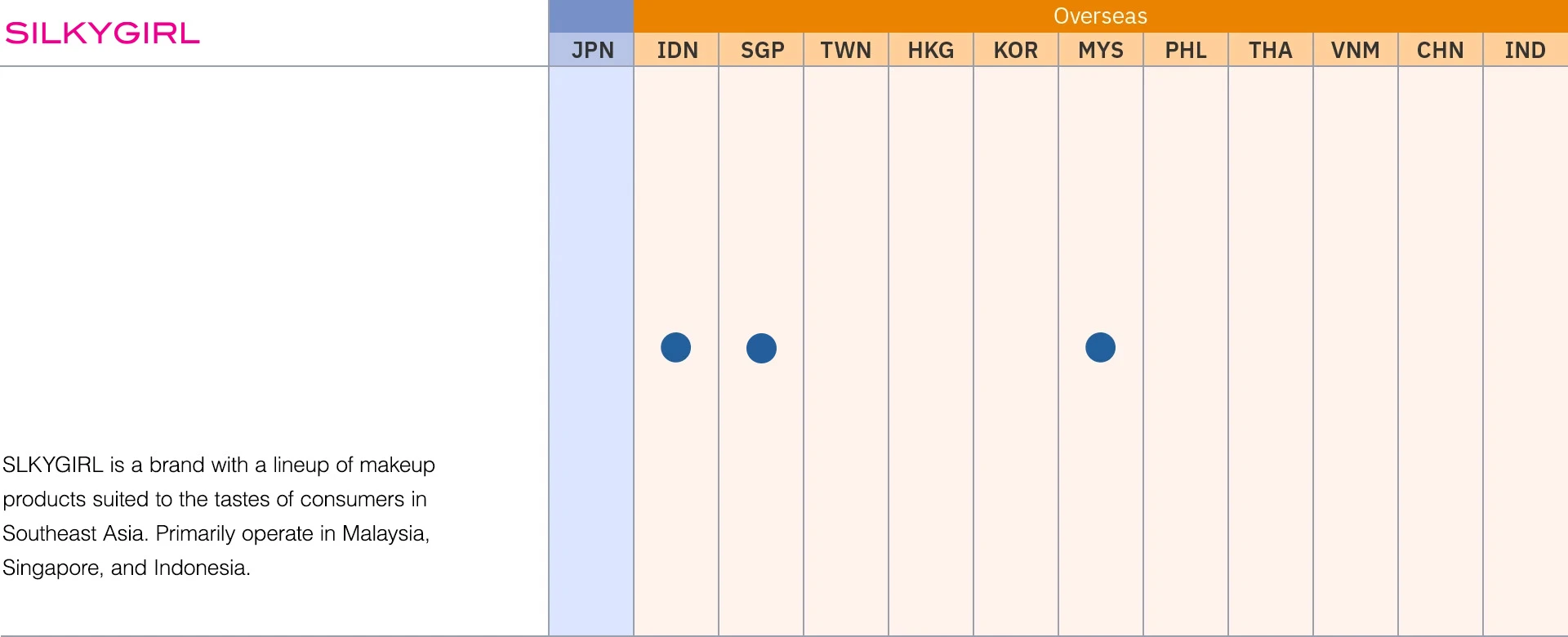

Major Brands

As of June 30, 2025